The Only Way Is Up: Five enterprise acquisitions to vertically integrate into major data center operators

Now could be the right time for data center operators to try and buy Dow Inc, Chart Industries, Koch and Noctua; and partner up with GE Vernova, Siemens and Mitsubishi.

As data center portfolios continue to rise, at what appears to be a fairly exponential rate, it could soon be the time where the true differentiator between those in the sector who dominate and participate will soon become that of vertical integration, a concept that is relatively well practiced in other industries. Basic examples could include a holding company which owns a care home, funeral directors and a florist. A modern tech example would be a company such as Apple; whereby the hardware, software, and other ancillary services and devices are all monetised as different streams to the same customer.

The benefits of vertical integration are two-fold:

Reducing the business's operating costs by purchasing enterprises which represent a large proportion of their overheads. As a method of saving costs or potentially generating additional revenue by selling such services to other operators.

To generate an additional income stream exclusively by adding another line of services or products, to be eventually sold to the same end consumer.

The vertical integration in the context of data center portfolios could encompass a number of enterprises, predominantly to reduce the operating operational overheads and generate supply of key infrastructure components.

As data center portfolios expand, there's an increasing argument for merge or acquisition of manufacturing businesses; either for key components, or maintenance consumables. This enables a reinforced protection again any potential future price hikes or impacts from increased demand causing supply shortages.

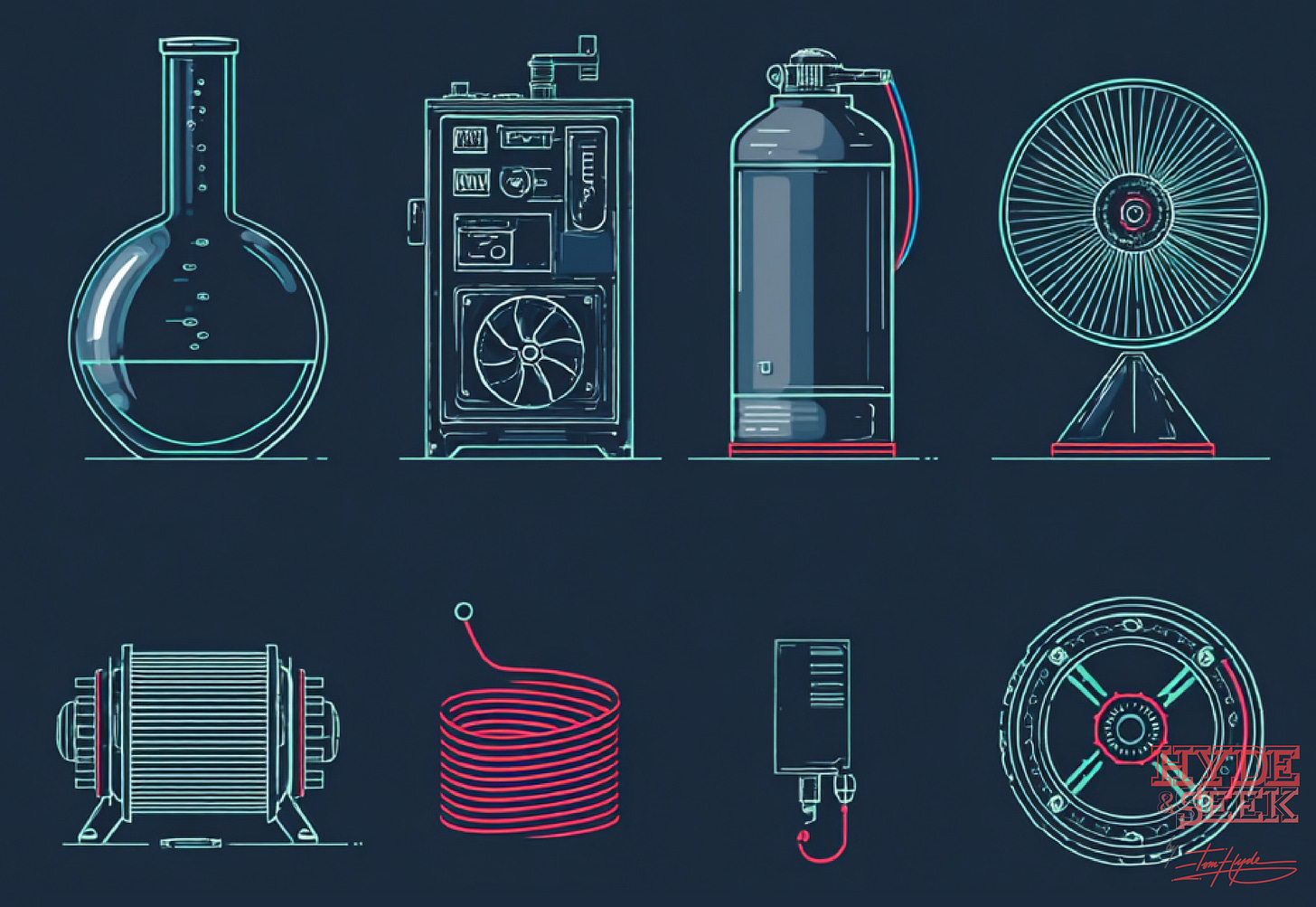

The two key obvious sectors would be cooling and refrigeration for consumables; and also power generation and connectivity for construction and fit-out.

I’ll cover my take on the 5 which makes the most practical sense as things stand at present.

Glycol Production and Reprocessing - Liquid and hybrid cooling continues to pervade as the main methods of cooling within data centers of varying sizes, owing to the liquid’s additional heat capacity (compared to air) to produce a more efficient cooling solution. At present, the most favored and stable solution for coolants are glycol-based liquids. Such coolants must be selected carefully to ensure specific properties to avoid damage to very costly equipment and in addition to ensuring optimal efficiency from the product.

Glycol has naturally entropic properties; which effectively means it begins degrading soon after it is produced. It’s degradation is relatively slow, but fluids will have to be exchanged numerous times throughout a data center's life. This means a significant opportunity lies in the production, distribution, and thereafter the recycling of glycol based equivalent solutions.

The Dow Inc Heat Transfer Fuels Division would be a logical acquisition for a key data center operator; not only to ensure the protection of supply and quality of the product themselves but the additional benefits. They will also able to monetise this by selling to other smaller data center operators.

Fan, Compressor, Pump & Heat Exchanger Manufacturing - Not necessarily a consumable but a critical part of all data center construction. These are the key components involved within the liquid and air cooling system. These components form nearly all parts of refrigeration heat transfer and distribution systems for nearly all cooling solutions incorporated within modern data centers. The acquisition of such companies will not only enable supply to be created but designs refined to be more optimized towards the applications required.

I would suggest that the true opportunity exists in leveraging significant intellectual property generated through other unrelated industries to apply it to a solution more applicable to data center design. For instance, computer fan manufacturer of Noctua would be a great addition to further the advancement of cooling technology and application - few other companies have invested so much into air cooling computer components, and many designs could easily be scaled to suit larger airflows. Koch’s expertise in the manufacture of heat exchangers could refine the solution to a more specific degree also.

Again, successful deployment could easily result in additional monetization by distributing these products to other operators or industries.

Supercritical CO2 - What is thought to be the replacement for glycol-based coolants - the utilization of supercritical CO2 as a more efficient cooling strategy. Research into this field is still in its relative infancy, but solutions have indeed been applied with successful results, and continuous refinement to processes shows a relatively stable promise for this to be incorporated as a wider adoption.

Some factors - such as compressing the supercritical CO2 prior to heating - results in a far more efficient solution; and this can be incorporated as part of a closed loop system that effectively feeds itself. The costs of wide implementation of this system makes it largely prohibitive compared to glycol-based solutions at the moment, but this could be the perfect time to invest before this technology becomes widespread - enabling monetization to occur and scale throughout the adoption phases and entire product lifetime. Key players to invest in or merge with could be Chart Industries or Infinity Turbine.

Turbine Fabrication - It’s regularly stated that the power constrictions are the main issues with regards to data center expansion. Strangely, the issue is not necessarily generating the power, as many solutions do exist which could help to support any requirements in that regard. However, there appears to be a significant bottleneck within the fabrication and manufacture of turbines (specifically gas turbines) for power generation.

Although this may not end up technically being a merger or acquisition of the entire company, there could be a fair argument for data center operators to invest directly into GE Vernova, Siemens or Mitsubishi, to facilitate additional production lines for turbine manufacture or fabrication. This is to enable a continuous and steady supply these critical components, to avoid any bottlenecks in construction timescales or constrictions on expansion.

Wait times for turbine production from GE Venova are thought to be around four years with the lead time increasing continuously; so this is a problem that will not be overcome without some form of wider capital intervention.

Fiber Optics - Finally, fiber optic cabling is utilised throughout nearly all modern data center designs, and currently the technology has more than sufficient quality and speed to satisfy current and future technological requirements. No only will an abundant supply be required for all future constructions, there will likely be a requirement for upgrade of legacy facilities cabling - modernizing to fiber optic from copper found in traditional RJ45 connections.

This is an essential and widely required component, which would generate both significant overhead reduction, as well as the potential for additional revenue streams.

As the technology develops, there could be more other promising sectors - such as geological IP and geothermal installers and operators; silica and phenol producers/processors (key components of chipsets); and incentive to maintain a highly vested interest in semi-conductor manufacturers - predominantly TSMC, Intel, AMD, Nvidia and ASML.

The premise of a vertical integration is a sensible route which many industries have successfully implemented, and there could be numerous routes to incorporate additional enterprises into data center operators existing businesses.

TH

You may also find these of interest: