Maybe you've got to be a synergist to win it; a partnership that could help ExxonMobil retread the path of Rockefeller

The Texan titan and the Ninja of turbines - ExxonMobil and Kawasaki could be a match made in monopoly

There are few greater stories of how an average man became a titan of their industry; John D. Rockefeller, the founder of Standard Oil, was renowned for being ruthless and utterly formidable in many respects. However, magnitude of his success was really attributed to initially putting all efforts into cornering the supply; and then, latterly - controlling the distribution of it. A vertical integration carried out at such a scale that no other operator could begin to compete. And the reason that many antitrust and competition laws were drafted in the first place.

A 1911 ruling in the Supreme Court eventually split Standard Oil into 34 separate companies (some of which became today’s equivalents ExxonMobil, Chevron, etc.).

The modern approach is more one that Amazon has managed to create, but is alot more discreet in it’s practice. The character of Rockefeller would have never have worked under the Amazon structure; he would have never entertained a buyout acquisition or merger - there was only one transaction worthwhile to him; and that was to acquire your business wholly and exclusively - by any means necessary. Amazon has managed to achieve a similar level of success and expansion, but has done so in a more competitive market; and although many of the investments have paid off, rarely have they escaped from having to pay the market rate to acquire businesses.

Synergy in Energy

An even more modern approach is one of more of a temporary synergistic partnership between companies - for a short-term gain in order to achieve a certain project goal or a one-off investment, whilst still retaining the flexibility to tread your own path or to break away from the agreement in pursuit of something greater that aligns more with what you want to achieve.

Rockefeller is an example of how a monopoly can be temporarily leveraged to extract as much value from it as possible before it is scissioned, whilst still retaining much of the return generated with little diminishment of individual brand or company value. Even when Standard Oil was order to split, there still remained a conceptual inertia to the market share that had already been captured; that success was nearly largely guaranteed.

So, is there another modern day partnership that could leverage the same amount of benefit to both the wider economy and the general consumer whilst developing a remarkable presence within the market, potentially eclipsing that which either have achieved already?

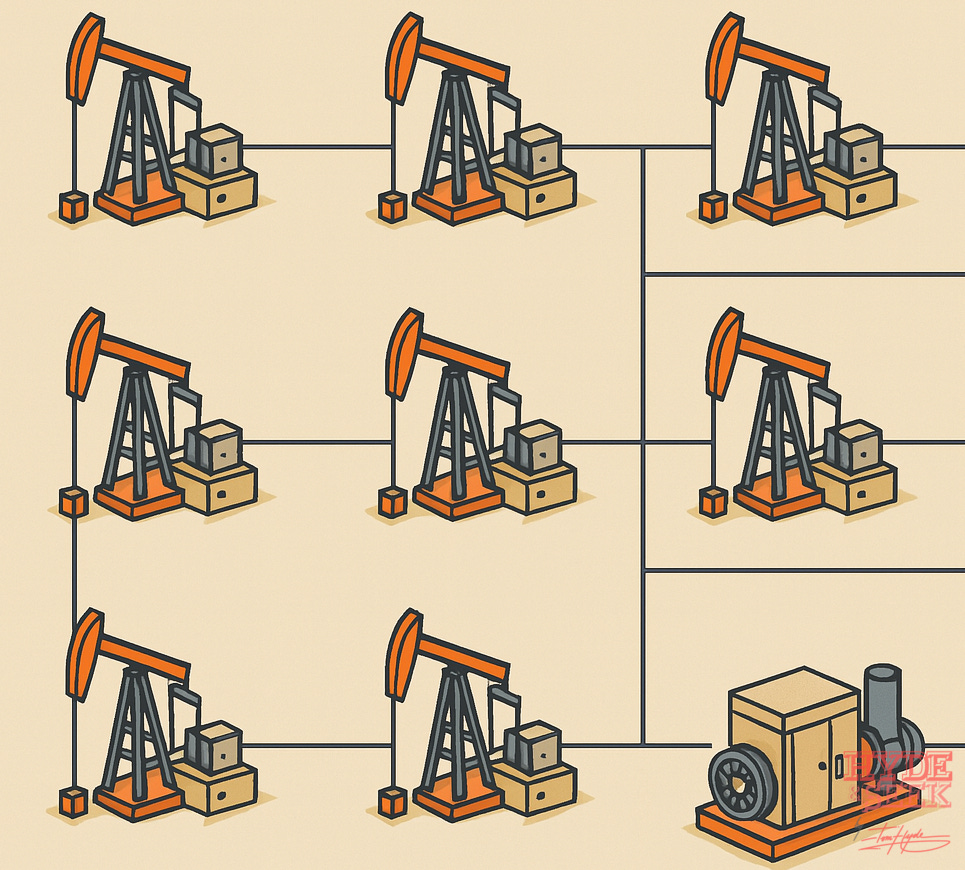

The modern day Rockefeller is undoubtedly ExxonMobil in the USA, with the largest land holdings and extraction licences spanning millions of square miles across the nation, operationally dominant and yielding efficiency and scale.

The other half of our modern day partnership may not be one that instantaneously comes to mind, but ultimately assists in providing a similar solution - albeit a different point in the process. These are my thoughts on how a partner, such as Kawasaki Heavy Industries could become the secret weapon in developing rapid infrastructure across conventional power sectors within the USA. Accelerating development, investment, local prosperity and unfathomable profits for both parties.

ExxonMobil's part would not necessarily be the supply of a raw commodity; but rather the waste product it produces. Look across the night sky of an oil field and you'll see it lit up with flames. These are gas flares as a result of the extraction process to avoid unnecessary pressure building up. The methane gas needs to be released and instead of just a simple atmospheric discharge for safety concerns, the methane is burned off and ignited, creating balls of flames that often run for hours at a time. As long as Exxon Mobil continues to extract their predominant product, their waste product could be utilised. There are some instances where, in some oil fields, depending on proximity to other populations, the methane gas can be collected and often recycled in other industrial processes, sometimes to run some processes within petrol refineries or other local uses. However, there are still many instances where locations do not necessarily create a viable economic proposition to collect and extract as required.

Where does Kawasaki come into all of this?

When it comes to the gas turbine market within the US, (the critical equipment utilised to convert the raw gas into useful electricity), there are only a handful of major players that typically seem to dominate the majority of the US market. GE Vernova, Siemens Energy, and Mitsubishi Electric operate a large proportion of the gas turbine market in the USA. Demand is typically for large-scale turbines to be housed in major industrial power generation facilities serving entire districts, regions, cities, or other densely populated areas.

Meanwhile in Japan, Kawasaki Heavy Industries is thought to have an excess of over 70% of the market share for gas turbines. However, their specialism is not in the production of large turbines, but more in small to medium scale. In contrast, their US presence is relatively minimal, other than a partnership with Cummins Engines currently. But market share is distinctly less through their US subsidiary, typically as a result of the US market not demanding smaller turbine sizes overall and their current restraints not enabling them to develop and produce a large-scale turbine.

The Opportunity:

But here's where the synergistic partnership lies: If we look at what we lack, what we require, what we've got, and the resources to deliver that:

1. We have a requirement for upgrading infrastructure throughout the entirety of the USA. Continuous interconnectivity required to be developed throughout all regions, rural and urban.

2. We have a requirement for electricity on all fronts: Capacity, distribution, and scalability

3. We have a waste product that is produced readily, continuously, but typically in small batches, as and when operational.

4. We have a company producing high-quality, trusted, and proven equipment successful in other markets directly suited and applicable to be adapted and implemented to utilise this waste product.

5. We have a business with a low market share in the US, with a potential to develop a strong foothold within the US market; in addition to contributing towards the US economy by expanding infrastructure, connectivity, and environmental sustainability of their operations.

The Long Play

The current bottlenecks in the current gas recycling efforts is typically the lack of pipeline networks between oilfields; and currently the inevitable challenge of processing and transferring a colourless, odourless product is just that of storage in sealed containers. Although this does save the waste product, it still exists in a form hich has a limited use case in its raw format, and it remains useless until it incurs further distribution costs in getting the stored raw product to a processing facility.

There exists an opportunity to develop a variant of portable, potentially modular solution which can be transported to site - a concept that Kawasaki have pioneered already with other models in their turbine range.

With basic distribution equipment - lorries, semi-trucks or others - temporary installations can made whilst fields are operational, and electrical grid structure slowly built out to increase distribution of the generated power. Once those oil fields are decommissioned or deemed to have dried past an economic extraction - there now exists new grid infrastructure to enable these areas to be developed at a later date.

With sufficient power distribution already existing in place, the turbines are relocated to an area where they would generate more efficiently. The revenues generated from the sale or use of the generated electricity from the waste product would eventually assist, if so desired, in funding a permanent installation to centrally distribute power between expanses of oil fields through other conventional or renewable technologies.

The build out of grid structure throughout sparse regions will enable development to occur within these areas that were once deemed to be unsuitable for development.

Sublet arrangements would enable additional returns to be generated from land which had no further economic value to ExxonMobil. Kawasaki would control the distribution of electricity throughout the area, giving monopoly on effectively the prosperity of the area, which will remain dependent on the continuous supply of electricity in order for modern economies to survive and thrive.

Even if not populated at this stage, there will be scope to enable the installation of other necessary infrastructure deemed to be unsafe, unsightly or unsavoury to be in proximity to populations - such as data centres, manufacturing processes and facilities for chemicals or otherwise.

Though the tale of Rockefeller is well told and fully understood by this point, our regulatory authorities would not typically enable such things to occur to the same degree in today's modern world.

However, there is an inevitability that comes when operators who are providing commodities of such significant value and essentialism exist within the economic domain. With limited government resources to invest in this equipment themselves, these operators must be given sufficient rein to use their wealth to their overall population's advantage.

Rockefeller may not be necessarily reincarnated as ExxonMobil and Kawasaki but there are certainly benefits that could exist from synergistic partnerships between industries. I believe now is the time to take a borderless approach between industries, expertise, value, and resources in order to develop the physical world at the rate that humanity demands it.

Of all the factors to attempt to retain as we navigate into a new revolution of the way that we live and interact with modern technologies, human capital needs to be preserved urgently and with more consideration than at present.

We require titans of industry to do this, and must accept that although some will undoubtedly profit to a significant degree from such developments, they also facilitate a different type of profit in the lives of the wider economy in terms of resources available to them, purpose, ability, skills, quality of life, and otherwise.

Rockefeller was widely regarded as a titans of industry for creating monopolies, and they were also regarded as incredible philanthropists, supporting gifting much of their wealth back into the system that helped them create it. We should not be shy from enabling companies to prosper, even to a large degree. We should be enabling it, but perhaps just a little cautious as to who we allow to benefit from it.

TH

You may find these of interest: