Ctrl+Alt+Delete on Data Center Appraisal: A holistic asset algorithm that redefines conventional valuation methodologies

There's a smarter way of valuing data center sites - one that's objective, formulaic and pragmatic. No need to attempt a comparative methodology of hugely different sites.

The more I've dug into the barebones of data center site deals, I've been left more confused than informed. Every deal is different. All can vary widely; with the valuation figures fluctuating wildly depending on:

Site location - and necessary local valuation of industrial sites.

Proximity - to services and infrastructure (and available capacity)

The purchaser - whether it's an owned and operated site by big tech, or venture capital funded and leased.

The required investment to make it suitable for purpose.

Each of those are broad titles, but there's much more nuance in the detail of each; one company may be seeking a hyperscale site, which would require a huge amount of infrastructure upgrades; another may be looking at a site for a more simplistic conventional compute expansion. The same site will be worth hugely different sums to each party.

For valuers, this is a bit of a nightmare. Presently, most values are assessed through comparative methodology - finding out what other sites sold for the locality, and adjusting the value based on that. But this still introduces too much room for error and variance in valuation - a similar sized site in the same zip code area, but with ten times the available power capacity is worth a hugely different sum.

I believe there's a better way of valuing data center sites - and we can do it mathematically, formulaically, and algorithmically. If we distill it down, a site's suitability is basically the combination of:

Site location

Power capacity and proximity

Connection speed and latency factors

Proximity to water bodies and mains water pressure

The suitability of a site depends on whether each of the above fits in alignment with the purchaser's requirements for their hardware operation. And the more aligned it is, the more valuable it is to a purchaser.

The strange thing about the existing methodology is that it applies a qualitative valuation approach to factors which all have quantitative metrics attached to them. For instance, the available existing power capacity to a site will be a specific, certain amount of MW (or GW) - and yet it's only ever used as a loose indicator to inform value, without ever being tied to it.

We've got other valuation methodologies that use quantitative data to inform the capital value - income capitalization, cost approach, residual and profits methods; so we can use those as a basis to coming to a solution to a more rigid approach to determine value.

Tying all of the main site metrics together can give a scoring of a site's suitability; and then that score can be tied to the value of other local generic industrial real estate to give a specific value.

The approach: constructing a Data Center Valuation Suitability Index (DCVSI)

To come to a suitable figure for assessing the suitability and value, we need to factor in the following attributes to enable a fair assessment between sites:

Hereafter, it's quite a simple process:

We gather the specific values for those key attributes (power, power proximity, fiber connectivity, proximity and water pressure, site size)

Assign relative weights to them based on importance

Normalize the values so they can be compared and combined

Produce a Valuation Suitability Index (VSI) that can be multiplied by a market price baseline to give a value.

Scoring and Weighting the Attributes

My method is creating a straightforward normalized score for each attribute - scored on on a 0–10 scale; then we can assign weights based on importance.

Suggested example weightings (these are adjustable based on your client preferences; but ultimately most are held in a relatively similar weight):

Power capacity: 35%

Fiber connectivity: 25%

Cooling water proximity: 15%

Mains water pressure: 10%

Site size: 10%

Proximity to power source: 5% (admittedly, this is already somewhat captured in power capacity, but still relevant)

VSI Components and Attribute Formulas

The VSI is a formula that brings these factors together into a single, comparable score from 0 to 10. To construct it, we'll firstly gather the algebraic components of each attribute:

1. Power Capacity (P) — Weight: 35%

The single biggest constraint for a hyperscale deployment. We score this on available MW against a hyperscale target, capped at 10.

2. Fiber Connectivity (F) — Weight: 25%

Speed and redundancy drive uptime and latency. Scored on available Gbps plus a redundancy bonus.

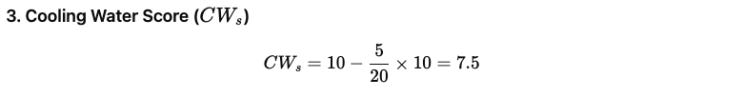

3. Cooling Water Proximity (CW) — Weight: 15%

If you’re near a large body of water, cooling becomes easier and cheaper.

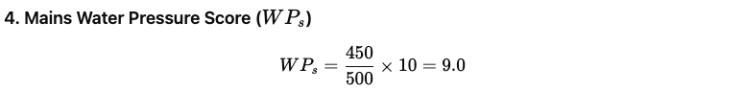

4. Mains Water Pressure (WP) — Weight: 10%

Good mechanical mains water pressure means less pumping cost for mechanical cooling, and improved flow and circulation.

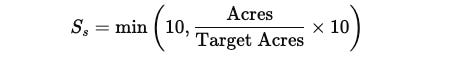

5. Site Size (S) — Weight: 10%

Bigger sites will inevitably provides more options for growth and expansion.

6. Proximity to Power Source (PP) — Weight: 5%

If a site is closer to a substation, it will translate into faster deployment and less setup and fit out cost.

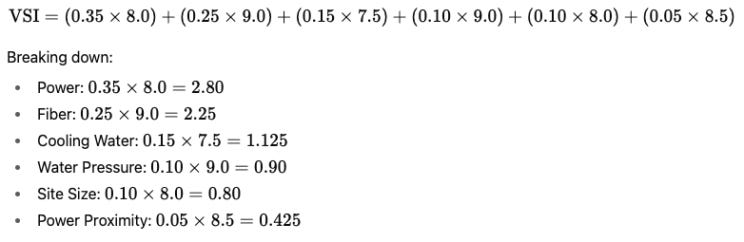

The VSI Formula

We bring the above together into a full VSI formula to give our score out of 10.

VSI to Value

Once we've scored a site, it's just a case of multiplying the site size by the average local market price per acre for industrial properties, and then by the weighted VSI function. This will look like:

Putting it all together: a worked example

We'll use the suggested earlier weightings for our example:

Power capacity, Ps: 35%

Fiber connectivity, Fs: 25%

Cooling water proximity, CWs: 15%

Mains water pressure, WPs: 10%

Site size, Ss: 10%

Proximity to power source, PPs: 5%

Firstly, we'll define what our (or our client's) requirements are for their site:

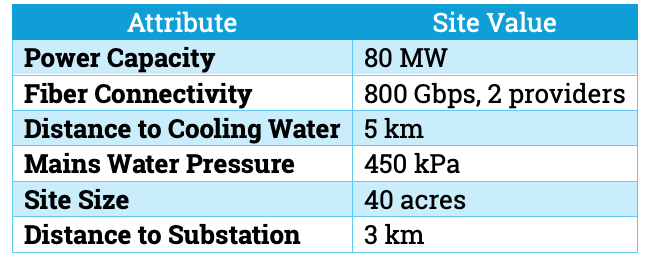

Next, we'll gather the metrics for the site we're assessing:

Now, we'll score each attribute using our above formulas, utilizing the data from the above tables:

And now, we can use those values in our main VSI formula, to give our weighted VSI calculation:

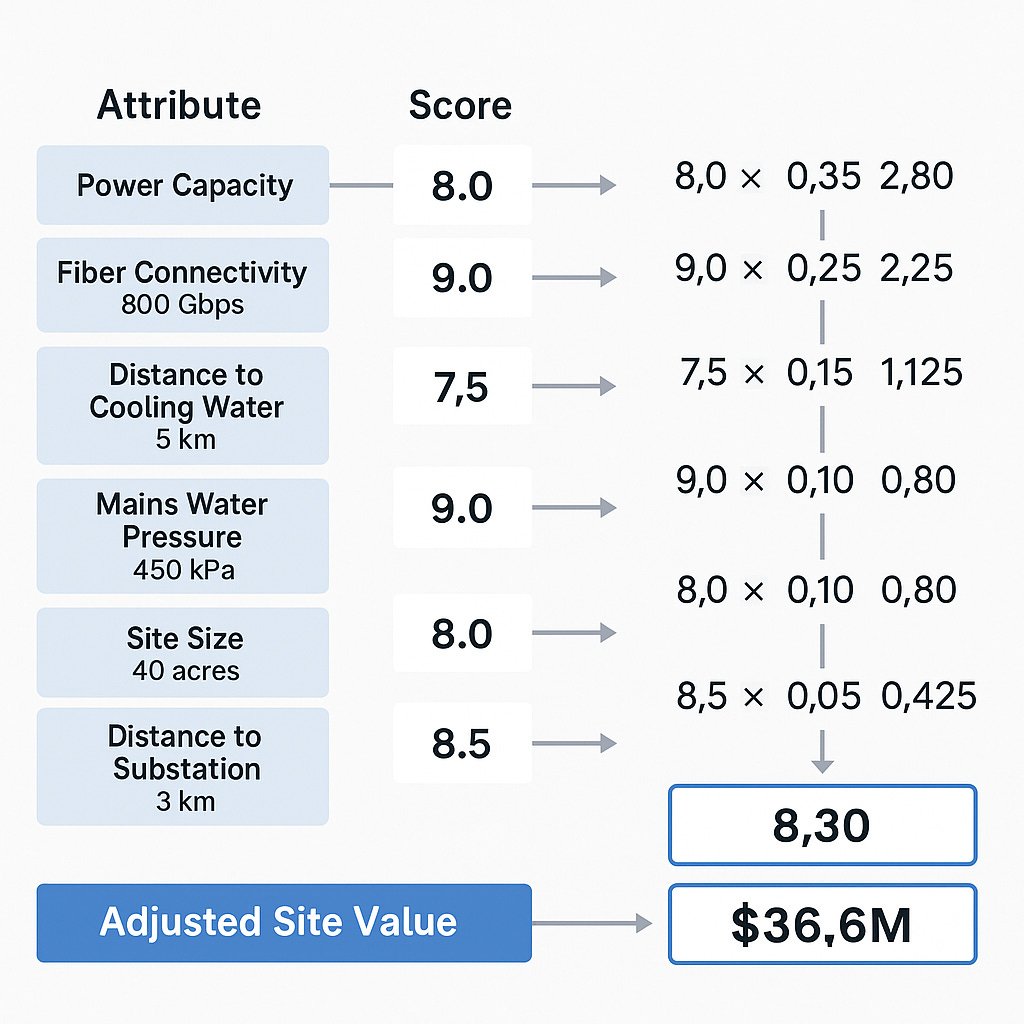

And finally, we can use our weighted VSI figure to inform our value:

Let's say our site is a 40 acre site, with a value of $500,000 per acre.

So our final figures:

VSI: 8.3/10

Adjusted Site Value: $36.6M (vs $20M base land value)

And that's the Data Center VSI Methodology

It's a much more refined model than comparable methods, and has benefits extending far beyond the valuation of sites for conveyancing and acquisition; this approach lets developers, investors, and municipalities speak a common language:

Developers can prioritize high-impact sites.

Investors and purchasers can compare apples to apples across regions.

Cities and local governments can identify infrastructure upgrades that directly boost land value.

TH

You may also find these of interest: